Not sure which currency to take abroad? This country‑by‑country guide shows when to bring dollars, euros or local cash, where to exchange, and how to avoid fees.

When planning a trip abroad, one of the practical dilemmas is which currency to take. Dollars, euros or the local money? Where and how is it best to exchange cash? These choices affect not just how convenient payments will be, but also how far your travel budget stretches.

Every country has its own rules of the game. In some places dollars work well, elsewhere euros are more convenient, and sometimes only the local currency is accepted. Small details matter too: the condition of your banknotes, their denomination and where you exchange them can all change the outcome.

Below is a clear, country-by-country look at what to bring and how to pay in popular holiday destinations — Turkey, Egypt, the UAE, Thailand, the Maldives, Indonesia, Sri Lanka, Cuba and Vietnam. With the basics sorted, it’s easier to avoid needless fees and feel comfortable on the ground.

You can bring either US dollars or euros to Turkey — both are widely accepted in major resort areas. In private shops, pharmacies and souvenir stalls, paying in dollars or euros is usually straightforward.

Tour operators note that US bills printed before 2006 can be troublesome to exchange. Small stores or stalls might accept them if the notes aren’t too worn, but it’s hit or miss. Some outlets will even take rubles, though the rate tends to be unfavorable.

You can change money at airports, bank branches and exchange offices, including those in large malls. Look for yellow “Exchange Office” signs. Staff may ask for a passport, though not always.

Another simple way to get Turkish lira is to make small purchases at resorts in Antalya, pay in dollars or euros and take the change in lira. It’s a low-effort tactic that often comes in handy.

You can bring both dollars and euros to Egypt, though tour operators say dollars are the better choice. It’s sensible to carry newer series banknotes issued after 2006.

Slightly worn dollar bills might be accepted, but not everywhere. For those, it’s safer to exchange at a bank rather than a cash machine. Exchange offices will not take US notes printed before 2000.

Euros also work, but there’s a quirk: dollars and euros are often valued at the same rate, which makes euro transactions less attractive.

You can pay with dollars on the spot, yet exchanging a small amount into Egyptian pounds first makes day-to-day spending easier — bus fares, water, public toilets and similar small expenses are simpler with local cash.

Changing money at airports is not advised due to poor rates. Exchange points in resorts or at hotels usually offer better terms.

For Thailand, you can bring dollars, euros or Thai baht. Baht can be purchased in some major banks in Russia, but traveling with dollars is typically more cost-effective: they’re easy to exchange at a good rate.

Tour operators stress that all payments in Thailand are made in the local currency. Bringing rubles to exchange on arrival isn’t recommended due to poor rates.

Banks generally offer the best terms. Note that US bills from 1996 are widely refused by exchangers. Larger denominations — $50 and $100 — get the best rates, while smaller notes ($1, $5, $10, $20) trade less favorably.

If you have a foreign bank card, ATMs in Thailand dispense only baht and charge a fixed withdrawal fee of 220 THB per transaction. For frequent small expenses, cash on hand can save unnecessary fees.

In the UAE, dollars are the easiest and usually most advantageous currency to carry. Euros are also accepted, but the exchange rate may be less attractive.

Experts say US notes from 2013 and newer change at standard rates. Older notes might be refused or exchanged at a 5–10% discount to the official rate. In large malls, some shops may take dollars directly and give change in dirhams, which is convenient.

Banks tend to offer the best rates, though you should check their hours and be ready to show a passport. Exchange counters in malls are a popular alternative with good rates and no passport requirement. Airport and hotel exchanges are workable but typically less favorable.

For China, bring dollars and yuan. Local guides can help with exchanges if needed. Since foreign currency cannot be used for payments, dollars must be exchanged into yuan.

Newer-series US bills are the safest bet. You can exchange at the airport or dedicated counters, but hotel rates are usually worse.

Street and market exchanges are strongly discouraged because of the risk of counterfeits or swaps. If you can’t get newer US notes in advance, arriving with yuan is the safer path.

Across China, including Hainan, UnionPay cards work where POS terminals are available. Taxis and many smaller vendors don’t use terminals, relying instead on QR payments in local apps (Alipay, Tencent, WeChat and others). Russian UnionPay cards can’t be linked to these wallets yet, which makes carrying cash more practical.

For the Maldives, bring dollars or euros, with a preference for newer US notes issued after 2009 (ideally with the blue security strip).

Curiously, most hotels on the islands do not accept the local currency, the rufiyaa. Tour operators therefore advise against exchanging dollars or euros into rufiyaa on arrival in Malé.

Another detail: many hotels may not accept $1 bills. Smaller denominations like $5, $10 or $20 are more practical for everyday payments at hotels and shops.

For Indonesia, including Bali, dollars or euros are recommended. Newer US bills (post-2006) are preferable since older series may be rejected or exchanged at worse rates.

All payments are made in Indonesian rupiah, so exchange a portion in advance for taxis, shops and daily spending. Foreign cash isn’t accepted for purchases.

Hotel exchanges often have weaker rates. Opt for official banks or certified exchangers such as Authorized Money Changer and No Commission, which are more reliable and frequently offer better terms. Airport exchanges are available but may be less competitive.

Stick to transparent exchange points and avoid street counters where scams or hidden fees are possible.

On Bali, many places in tourist areas accept international Visa and MasterCard. In remote areas or for small purchases, cash in rupiah is essential. ATMs have withdrawal limits and may charge extra fees, so carrying a reasonable cash reserve can save time and hassle.

For Sri Lanka, both dollars and euros work, with dollars typically the more advantageous choice. It’s best to carry notes issued after 2009; bills from 1996 may also be accepted.

Tour operators recommend exchanging money at Colombo International Airport, where the rates are generally the most favorable. Many hotels (the vast majority) also offer exchange, but their rates are usually weaker.

Keep the official exchange receipt until departure. It allows you to change leftover rupees back into dollars or euros at Colombo at the buy rate.

Payments on the island are made in Sri Lankan rupees. In tourist zones, some hotels, restaurants and shops may take foreign currency, giving change in rupees.

For Cuba, bring both dollars and euros. Dollars can be used for payments or exchanged into Cuban pesos, while euros are often needed for excursions since many operators prefer that currency. Notes printed before 1996 may pose exchange problems, so newer series are the safer option.

Exchange money at official counters in resort areas or at hotels for more predictable rates. Airport exchanges are possible but usually less favorable.

In Havana and Varadero, Mir cards are accepted, though the conversion rate may be unattractive and poor internet can disrupt transactions. For tips, taxis and small purchases, carry cash in small denominations — this is one place where a little pocket money solves many annoyances.

ATMs are scarce and unreliable, and often support only some international cards. Plan your budget ahead and keep enough cash to cover your main expenses.

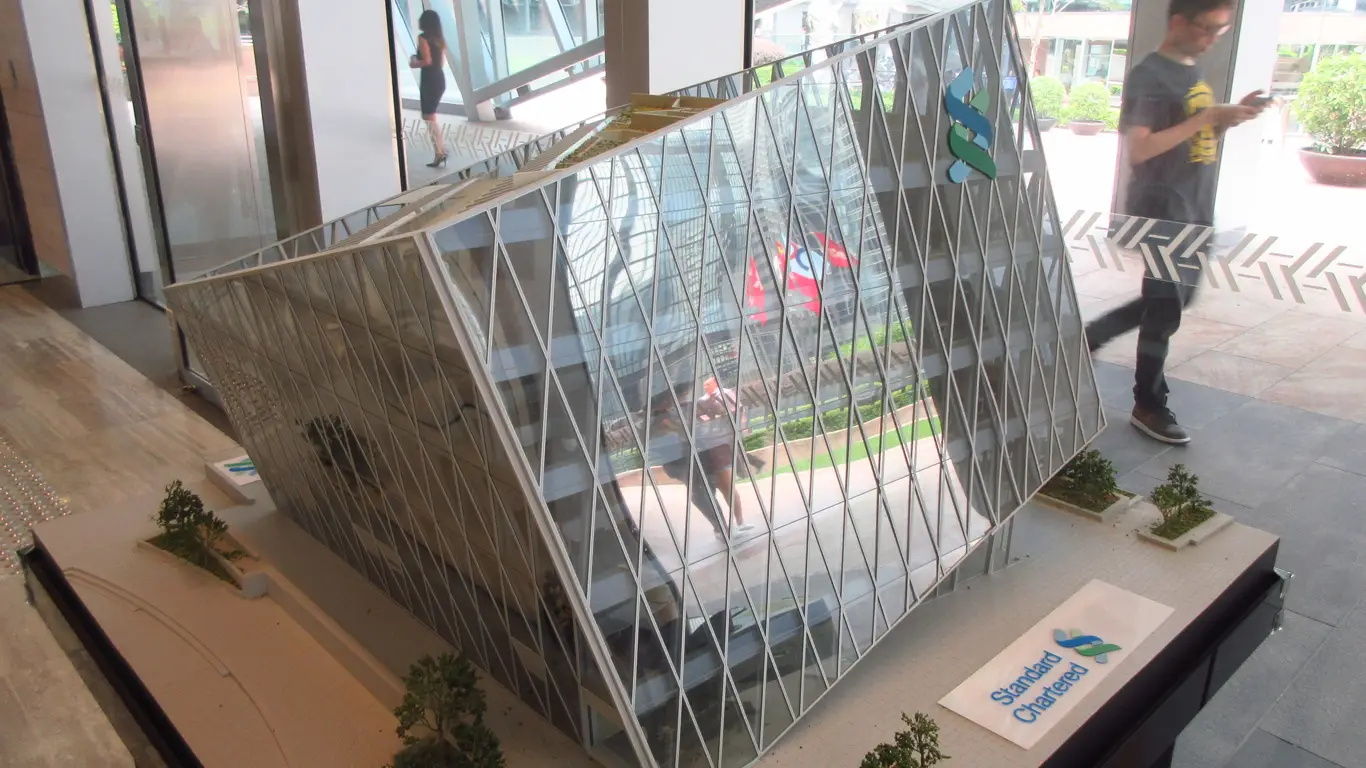

For Vietnam, bring dollars or euros, with a preference for newer US bills issued after 2006. Older notes may be refused or exchanged at worse rates.

Day-to-day payments are easier in Vietnamese dong. You can exchange at official counters, hotels, airports and even jewelry stores — the latter often have the most competitive rates.

Larger US denominations ($50 and $100) typically fetch a better exchange rate than small bills.

Foreign currency isn’t usually accepted for direct payments. In tourist areas, some places will take dollars or euros but give change in dong at a weaker rate.

Exporting dong is illegal, so it’s best not to keep it as a souvenir. If you have leftovers, exchange them back into dollars or euros at the airport before departure — keep your exchange receipt.

Visa and MasterCard can be useful for ATM withdrawals, though fees apply and per-withdrawal limits are common. For many travelers, a mix of cash dollars or euros plus local currency on hand proves the most economical approach.